The Emperor Has No Clothes!

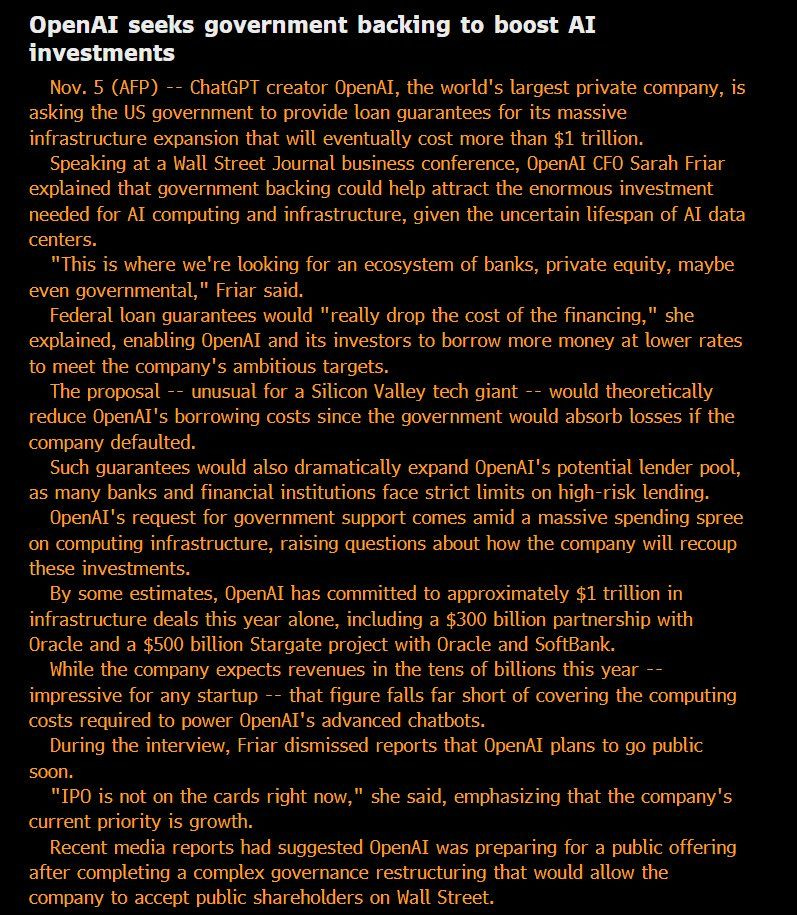

In a stunning development this week, OpenAI’s CFO demanded that the US Government backstop the enormous AI investments.

In other words, OpenAI wants taxpayers to guarantee its debt.

Notably, this came 24 hours after Jensen shocked the tech world by announcing that China will likely win the AI race.

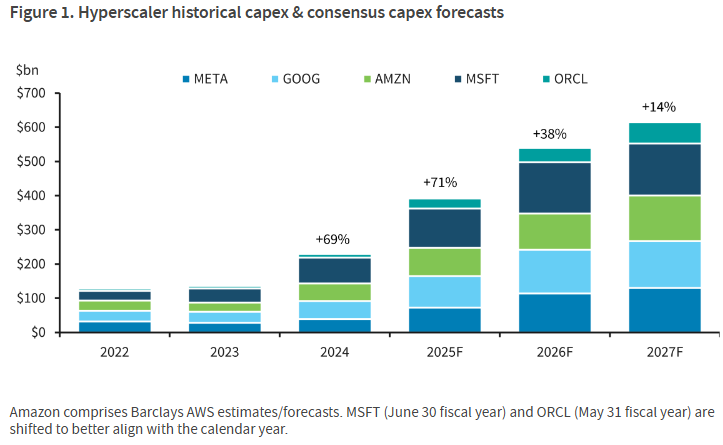

Concerns regarding the return on investment have grown larger on the street in recent weeks as debt-fueled capex has now reached unprecedented levels.

Total hyperscaler capex consensus is now $390bn for 2025 (+71% YoY), $540bn for 2026 (+38% YoY), and $615bn for 2027 (+14% YoY).

With drying free cash flows and breathtaking circular AI deals, we believe that we are gradually reaching a stage where Buffett’s famous quote will again come to picture: “When the Tide Goes Out, You Find Out Who is Swimming Naked”!

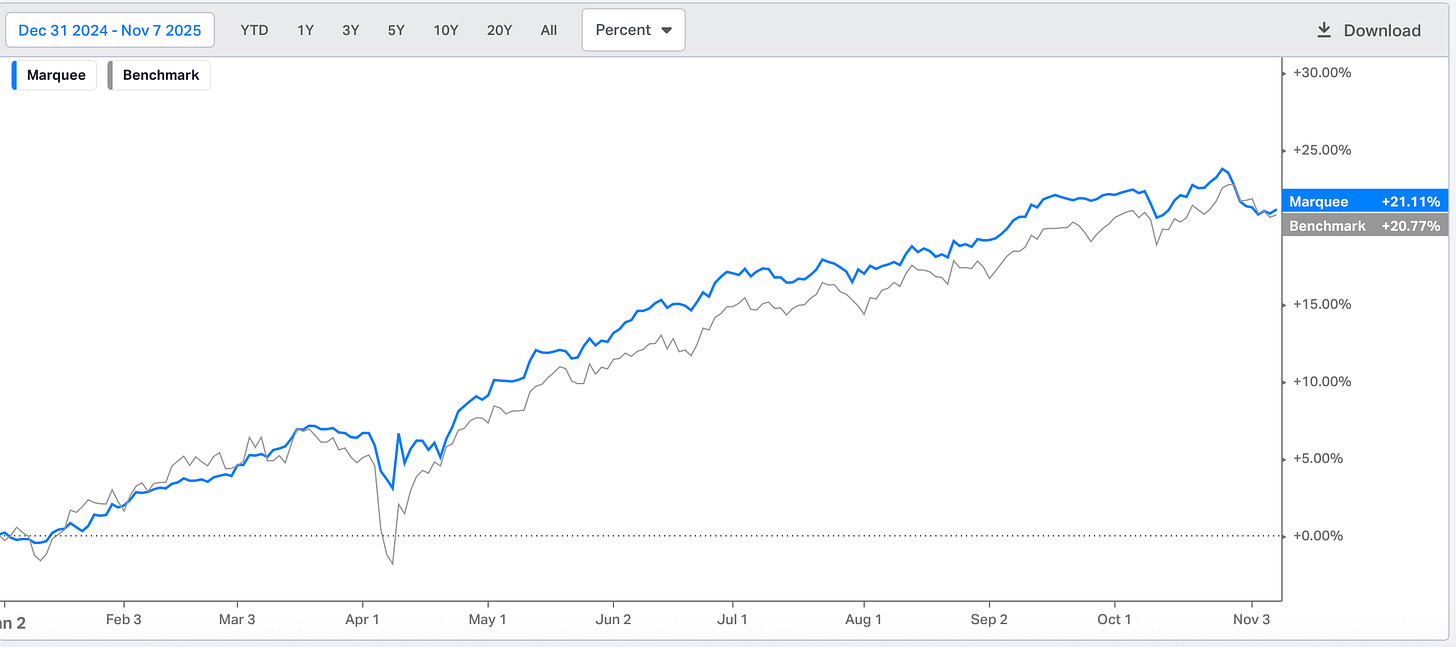

We erased last week's underperformance, and we are now again outperforming the benchmark by 35 bps, thanks to our timely short BTC call.

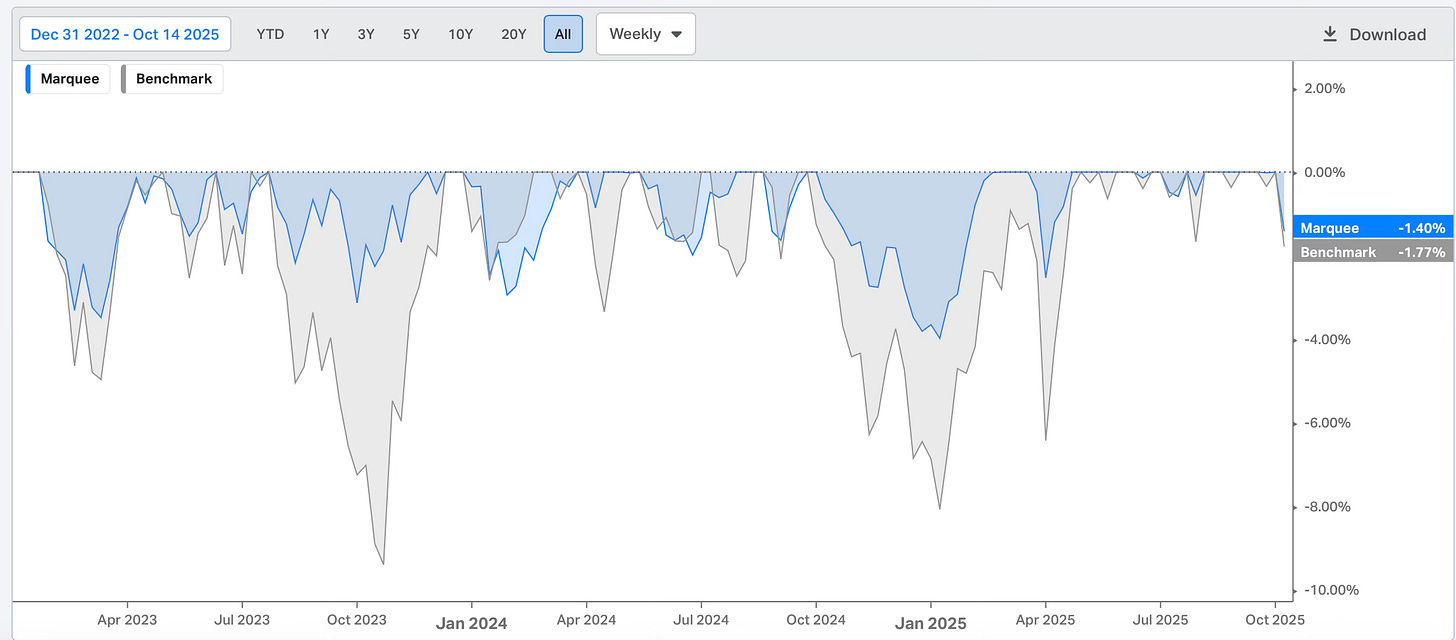

We are now officially in the largest drawdown since Liberation Day, with the PF down 140 bps from its ATH last month.

Let us now begin today’s newsletter and analyse the global macro with detailed cross-asset moves!

US/Bonds/Equities/Gold/Silver/Oil/Dollar/BTC!

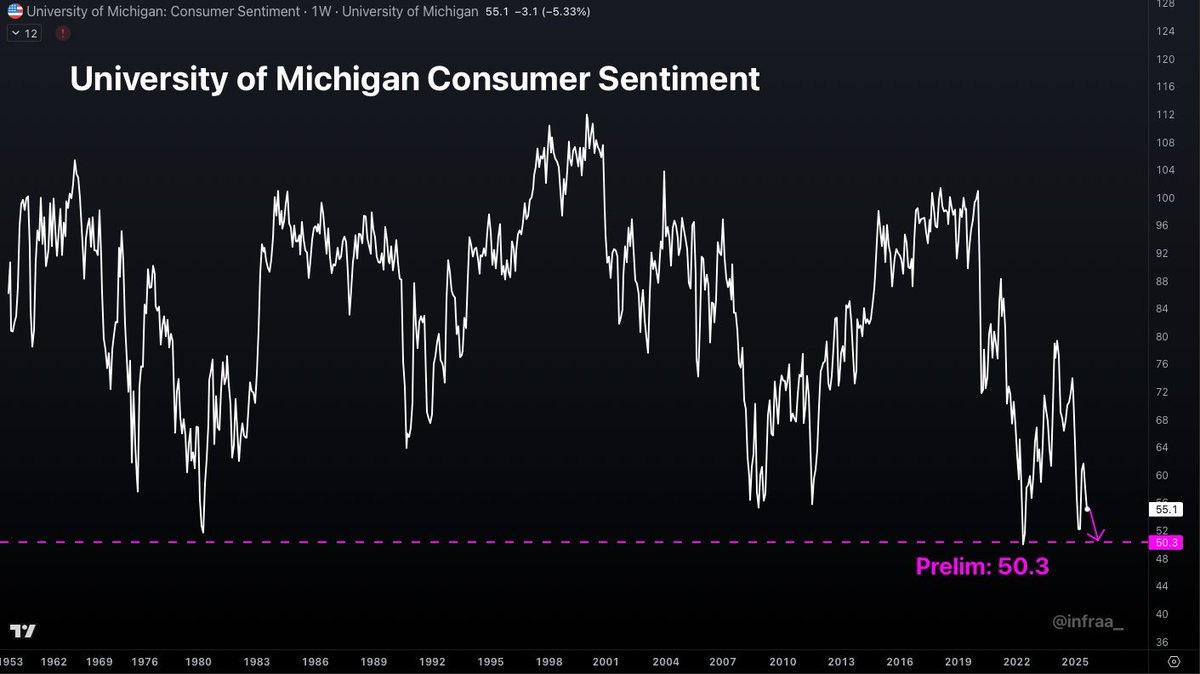

The Michigan Consumer Sentiment Index plunged to the second-lowest reading ever, indicating what we have been suggesting for the past few months (the K-shaped economy)

In fact, if we examine closely, the sentiment didn’t recover completely post-COVID, as high inflation has been eroding the purchasing power of low-income households.

As layoffs surge, expect the sentiment to crash to all-time lows in the coming months.

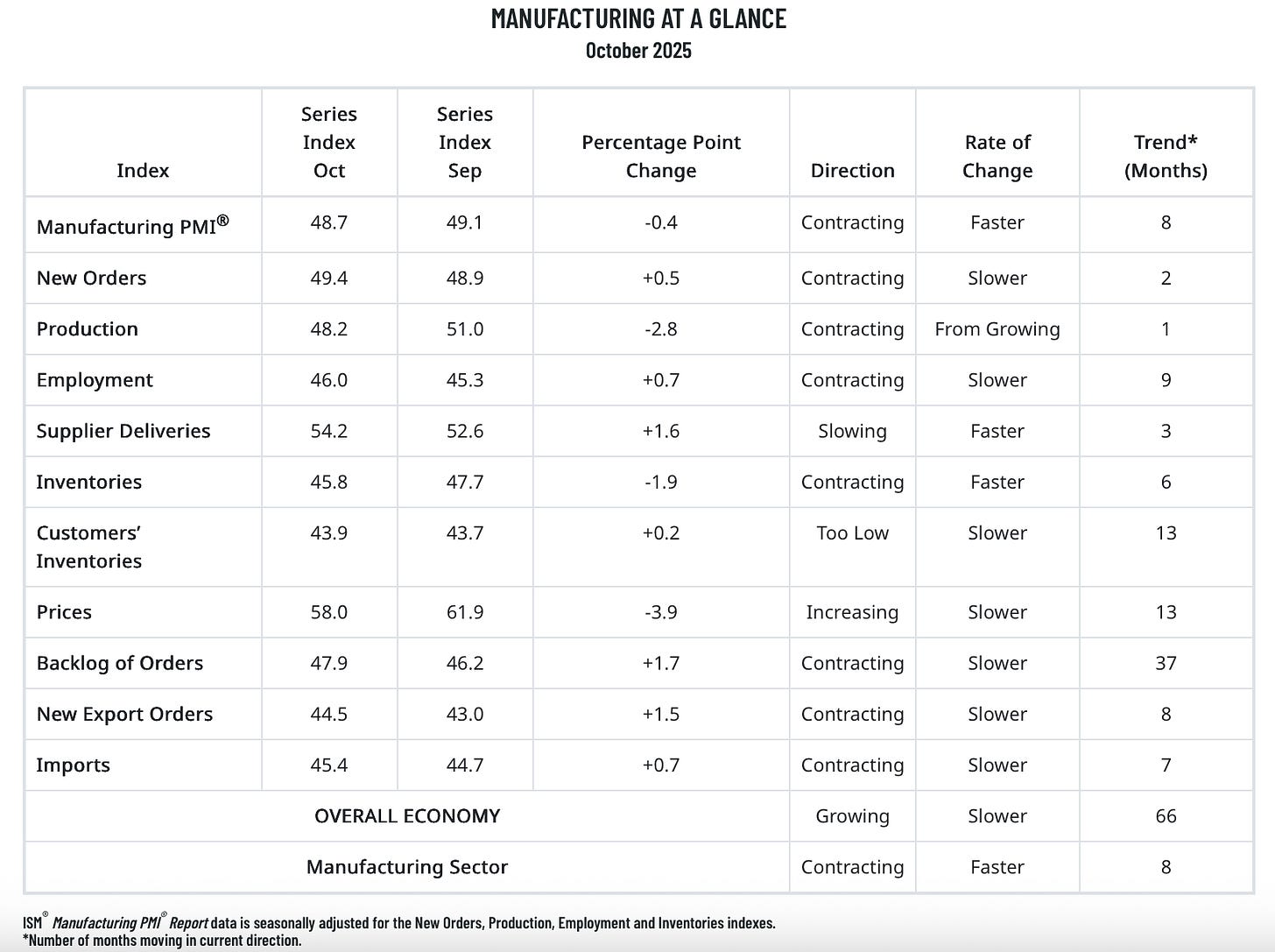

Our favourite gauge to track the cyclical economy was released this week.

The ISM Manufacturing remains in contractionary territory (below 50).

However, the greenshoot was the New Orders Less Inventories which have been sharply rising in the past few months (the trend is up).

If the historical data is to be believed, we may see the ISM Manufacturing headline number rise above 50 in the coming months.

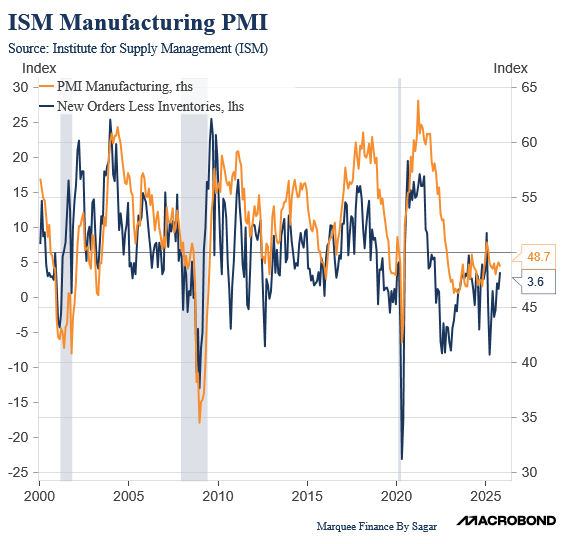

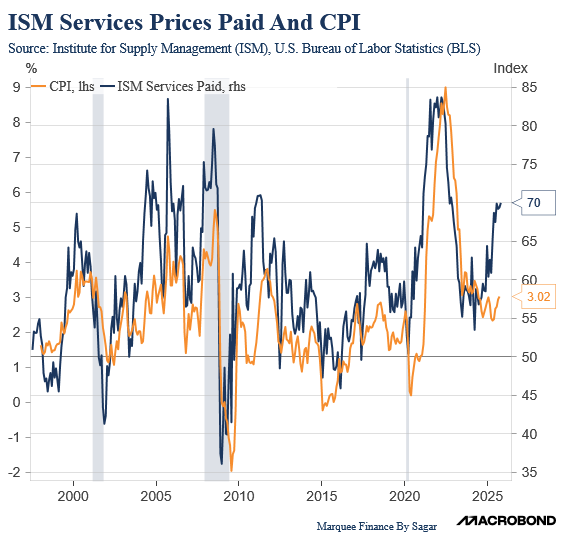

ISM Services came in higher than expectations, which led to a sell-off in rates.

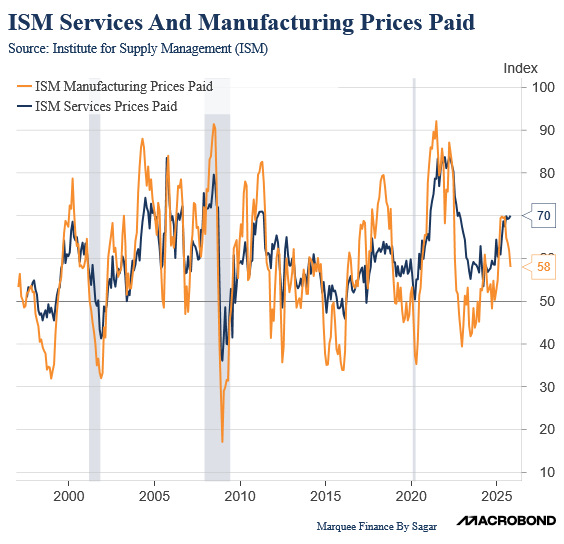

Furthermore, the ISM Services Prices Paid index came in higher (at 70) compared to the ISM Manufacturing Prices Paid index, which dropped to 58.

According to historical data, we believe that if the Manufacturing Prices Paid continue to fall, the ISM Services Prices Paid will likely follow suit.

Furthermore, if that’s the case, we expect the CPI to fall from Q2 after an initial spike in Q1.

Labour Market:

In the absence of official government data (NFP, JOLTS & Claims), we look at alternate data sources to assess the health of the labour market: