The Endless "Frenzy"!

“Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”- Alan Greenspan, December 5, 1996.

The contributions of Robert J Shiller, a legendary economist of our time, cannot be overstated. He is the mastermind behind the Cyclically Adjusted Price-To-Earnings Ratio or the CAPE Ratio, a tool extensively used by market participants, including us, to assess the valuation of the equity markets.

Furthermore, he also developed the Case-Shiller Index, a crucial instrument for tracking the US Single Family Homes price change. His work has revolutionised the way we understand and analyse financial markets.

Those who are not aware of Robert Shiller should immediately order his book, “Irrational Exuberance.” It was an eye-opener for us and will be for those who were not in the business of trading/investing/capital markets during the dot-com bubble; the book vividly describes the events that transpired during the dot-com bubble.

Ironically, Shiller predicted the burst just before it occurred. One of the book's highlights was how the bubble formation is accompanied by the hope of a “new era” igniting interest from the masses.

As the equity markets undergo an unprecedented surge in interest from the retail crowd in the hopes of the “Artificial Intelligence”/AI revolution/New Era, companies are taking advantage of retail flows, as happens during a bubble.

Ex: NVDA’s buybacks have been useless as employees redeemed their ESOPs, nullifying the buyback amount. Thus, profits used for buyback have “NOT” been benefitting shareholders. Moreso, the 10-1 split by now the third largest company in the US is a classic example of what happens during the end stage of the bubble.

We do not imply that AI will “not” be revolutionary, but we think it’s too early to predict how things will evolve and which companies will benefit when AI enters the mainstream.

Nonetheless, we will discuss the pros and cons of AI and the massive capex on tech companies next week. Let us begin today’s newsletter with a comprehensive take on global macro.

US!

Since this was a data-light week, we will examine various macro indicators today and decode the wild move in commodities.

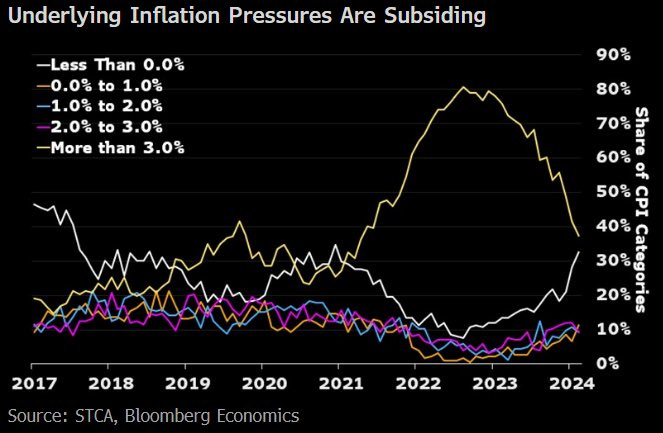

Before we began, we came across an interesting chart this week. The BBG Economics team deciphered the various components of the CPI data into various buckets to analyse the internals of the Consumer Price Index.

According to the data, underlying inflation pressures are subsiding as CPI categories with more than 3% gain are now heading considerably lower. Furthermore, components with less than 0% gain (disinflationary impulse) have increased sharply.

This leads to the following conclusions:

Only a few higher-weight components have led the headline CPI to a higher MoM (>0%). Notably, it has been shelter inflation for the headline number that has puzzled JayPo.

The Supercore CPI has risen to YTD highs, mainly due to auto insurance, while other components have been in line or have been disinflationary.

Nonetheless, the biggest takeaway from the macro perspective is that the CPI data is a lagging indicator, with some components like shelter having a lag of more than a year.

As a result, we look at some alarming “coincident” data points that indicate the disinflation process might stall in the coming months.