The Jackson Hole "Bombshell"!

“We cannot say for certain where rates will settle out over the longer run, but their neutral level may now be higher than during the 2010s, reflecting changes in productivity, demographics, fiscal policy, and other factors that affect the balance between saving and investment.”- Jerome Powell, 22nd August.

The post-pandemic financial markets have seen once-in-a-lifetime structural changes.

A month back, we highlighted some of the structural changes that transpired post-Trump took office in January.

However, one of the structural trends in financial markets has been the higher rates (especially super long-term), as we, along with other market participants, believe that the bond markets are demanding higher term premium considering the higher inflation (the 3% is the new 2%) and higher deficits (fiscal policy).

Jerome Powell reaffirmed that the neutral rate is now higher than in the 2010s, which we have been highlighting as the Fed has been gradually moving the estimates of the long-run projections higher in the SEP (Summary of Economic Projections).

This was the “hawkish” bombshell that the markets missed as they cheered the dovish shift due to the softness in the labour market. This statement clearly reflects that we are not going to 0, and the scope of rate cuts in total over the next 15-18 months remains limited due to a higher neutral rate.

Nonetheless, from the UK to Japan, the bond markets are revolting as bond vigilantes run wild.

The JGB 30Y yield touched 3.22% yesterday, the highest since 1998 (or when the paper was first introduced).

At some point, the long-term yields, if they continue to run wild, would cause a black swan event, and thus, the central banks’ intervention is imminent.

There will be repercussions when they intervene, and we will be prepared in that scenario.

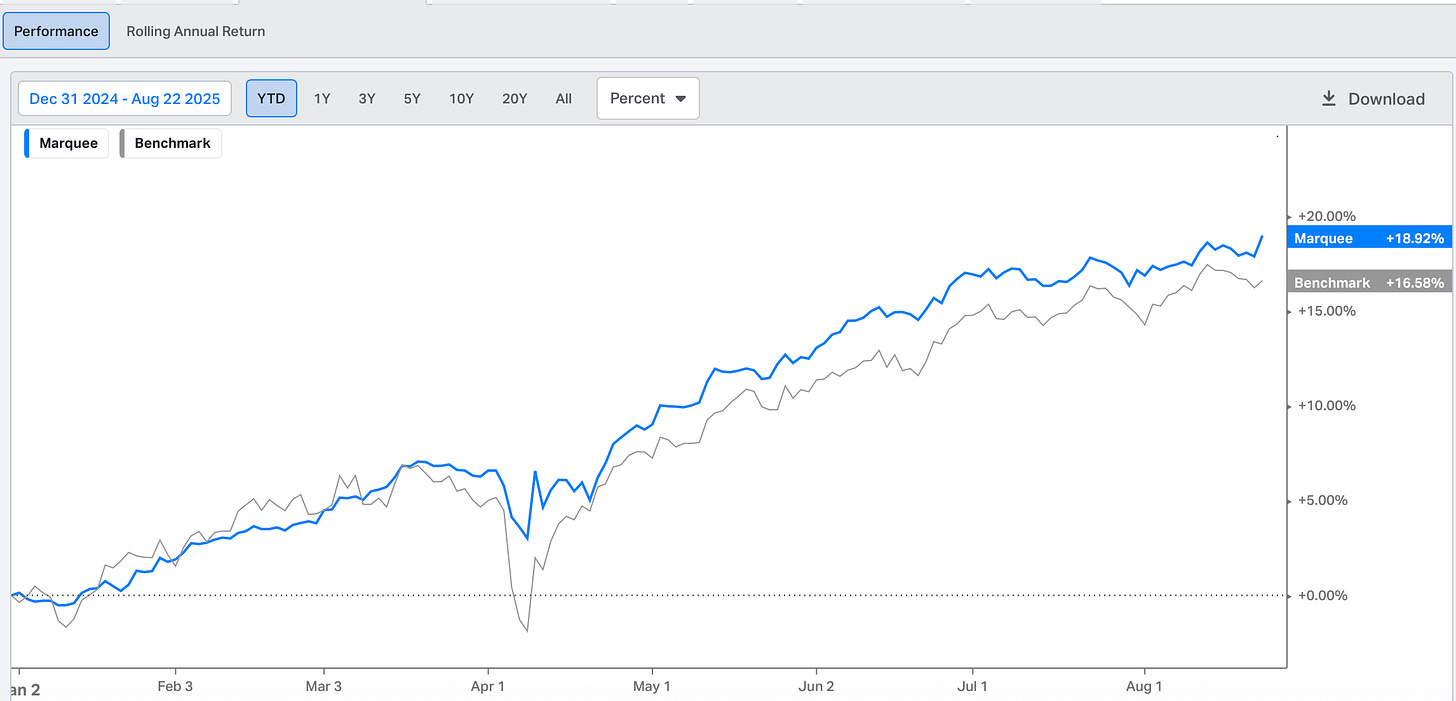

We closed at fresh YTD highs with a return of 19% beating our benchmark by 240 bps.

PS: Before we begin, we will increase our paid subscription prices to $29.99/M or $ 299.99/Yr starting 1st September 2025.

Note that subscribers who are currently enrolled or will enrol by September 1st will be subscribed at the mouth-watering current prices ($24.99/$249.99) “FOREVER”.

Furthermore, those who have subscribed at the original price of $14.99/$149.99 two years back will see no change in their plans.

Therefore, anyone who wants to take advantage of a 16% lifetime discount can subscribe until midnight on August 31st at the current prices.

US/ Bonds/ Gold/ Silver/Oil/Dollar!

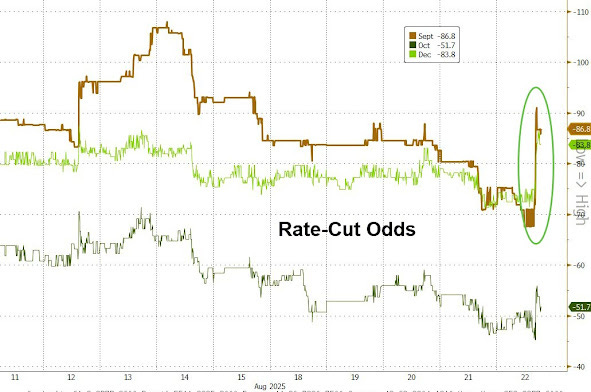

Due to the economic data released in the past few weeks (especially the hot PPI), the odds of the September cut, which reached 95% post the NFP, dropped significantly to around 50%.

Nevertheless, yesterday, this statement by JayPo was perceived as extremely dovish by the market.

Nonetheless, with policy in a restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

As a result, the rate cut odds for September jumped to 90% immediately after the Jackson Hole speech.

Furthermore, the market pricing for rate cuts for the rest of the year also changed dramatically.

Nevertheless, the markets are pricing in 5 cuts till next October, and the terminal rate looks closer to 3% (currently we believe neutral, which could rise further if inflation settles higher).

Before we jump to the detailed analysis of the Jackson Hole Speech, let us analyse the housing data which was released in the past few weeks.

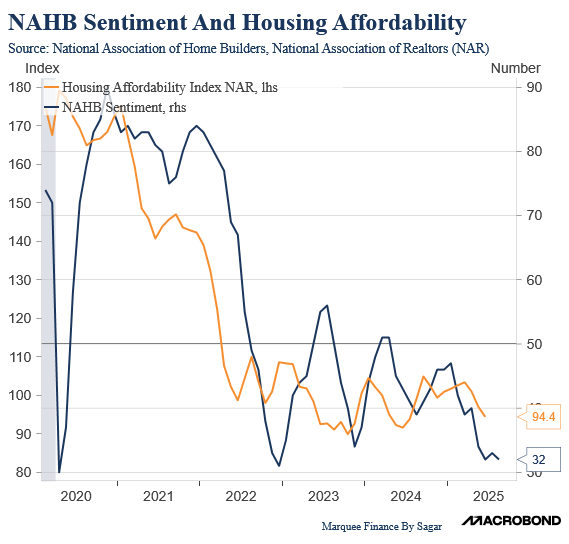

One of the reasons for the housing slowdown has been affordability. With high mortgage rates and super high prices, the affordability is hovering around all-time lows. Furthermore, the NAHB sentiment has plunged to post-pandemic lows, signalling the pessimism among the builder community.

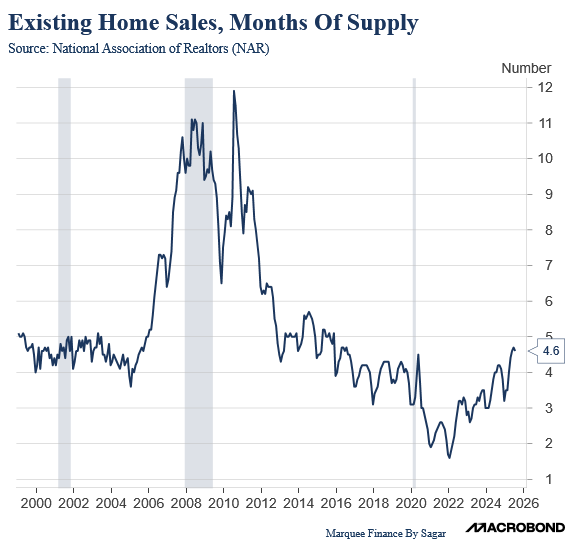

Existing Home Sales Months of Supply is the best measure to gauge the inventory scenario, and the future price action, because if the months of supply are high, we expect the prices to remain soft in the medium term unless the sales rebound (and months of supply drop). It’s a typical supply-demand metric at play.

When we look at the price action, with all the bearishness around housing, it’s a surprise that prices are still firm. Though the pace of rise has slowed, we are still not witnessing a decline in prices. Note that if the unemployment rate rises and the labour market deteriorates further, we can expect a decline in prices.

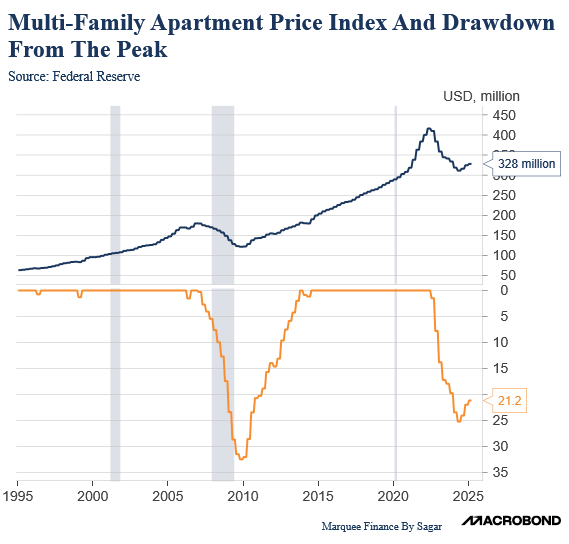

The Multi-Family Apartment Price Index is our last chart in the housing series. Post-2022 peak, we saw a significant drawdown (more than 20%). However, with asset prices at ATHs (equities, BTC, etc), there is a nascent recovery in the Multi-Family Apartment Price Index.

Now, let us dig deeper into the JayPo speech yesterday and look at the structural trends: