The Last Hurrah!

The art of Macro investing involves the study of business cycles and analyzing the stage of the business cycle while joining the dots around the globe.

Using historical precedents, macro investors allocate capital across assets according to the business cycle dynamics while managing risk.

Generally, the late-stage business cycles are characterized by “euphoria” or the hopes of a soft landing where the economy manages to escape a recession while bringing inflation under control and the labour market stays resilient (the unemployment rate remains well below the historical threshold levels of a recession).

Termed as the “The Last Hurrah”, the late-stage business cycle is marked by a rally in risk assets and a general risk-on environment. Though it’s incredibly challenging to get impeccable timing of the various stages of the business cycle, one can take a position and manage the position sizing in anticipation of the peak/trough in business cycles while addressing downside/upside risk (long/short).

Nonetheless, despite the fastest tightening of monetary policy ever, the current business cycle has been unusual thanks to the enormous fiscal and monetary stimulus post-COVID and the supply chain disruptions due to the pandemic.

Furthermore, a dramatic shift in consumer preferences and pent-up demand/ revenge travel led to distortions in the macro data.

The decoupling of the West and the East (monetary tightening v/s easing) with a multi-polar world has further complicated the liquidity and the macro scenario.

As the risk assets grapple with unprecedented flows, the market’s reaction to the recent data dump (if sustained) will mark a shift in the regime prevalent for the last 18 months.

Let’s take a deep dive into the macro world and comprehend what’s transpiring in the global financial system!

US!

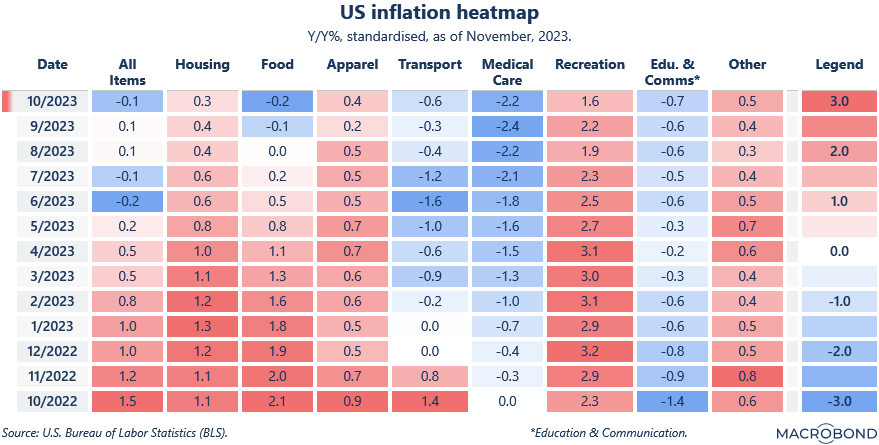

Touted as the most important data release of the month, CPI data was encouraging on most fronts.

However, there was an uproar on social media about the enormous fall of more than 34% in the health insurance YoY, thus challenging the headline miss.

The inflation heatmap indicates that the two heads still running hot are housing (shelter) and recreation.

One must appreciate that shelter is a massively lagging data piece that is cooling off fast and will fall further as we head into 2024.

Recreation services is a part of the core services ex-housing that has apparently become Powell’s famous indicator in the ongoing inflationary bout.

We had predicted that