The "Macro Surprises" Continue But....

"The Devil Lies In The Details"

Once again, we stand vindicated as our long-standing view of inflation bottoming out proved true.

While the raging debate among market participants continues, the undeniable fact is that unless the economy suddenly grinds to a halt, the tariffs are inflationary.

Nevertheless, we will delve into details today and analyse in depth the US CPI, PPI, NFIB and retail sales.

Moving from macro to geopolitics, President Trump is burning the midnight lamp to end the gruelling Russia-Ukraine war.

Though we are still not there yet, progress has certainly been made.

If we get an end to the war, there will be cross-asset repercussions.

Nevertheless, with the Fed’s independence at stake and Trump adamant about appointing a “dovish” Fed chair, we may expect fireworks in markets with outsized cross-asset moves.

We hit fresh YTD highs this week with around 18.5% return.

Our PF got a massive boost early this week as we captured more than 24% upside in Ethereum.

PS: Before we begin, we will increase our paid subscription prices to $29.99/M or $ 299.99/Yr starting 1st September 2025.

Note that subscribers who are currently enrolled or will enrol by September 1st will be subscribed at the mouth-watering current prices ($24.99/$249.99) “FOREVER”.

Furthermore, those who have subscribed at the original price of $14.99/$149.99 two years back will see no change in their plans.

Therefore, anyone who wants to take advantage of a 16% lifetime discount can subscribe until midnight on August 31st at the current prices.

PS: Please avoid Apply Pay while you pay for your subscription as it charges very high fees. Also, do check your invoice for any discrepancies.

US/Bonds/Gold/Oil!

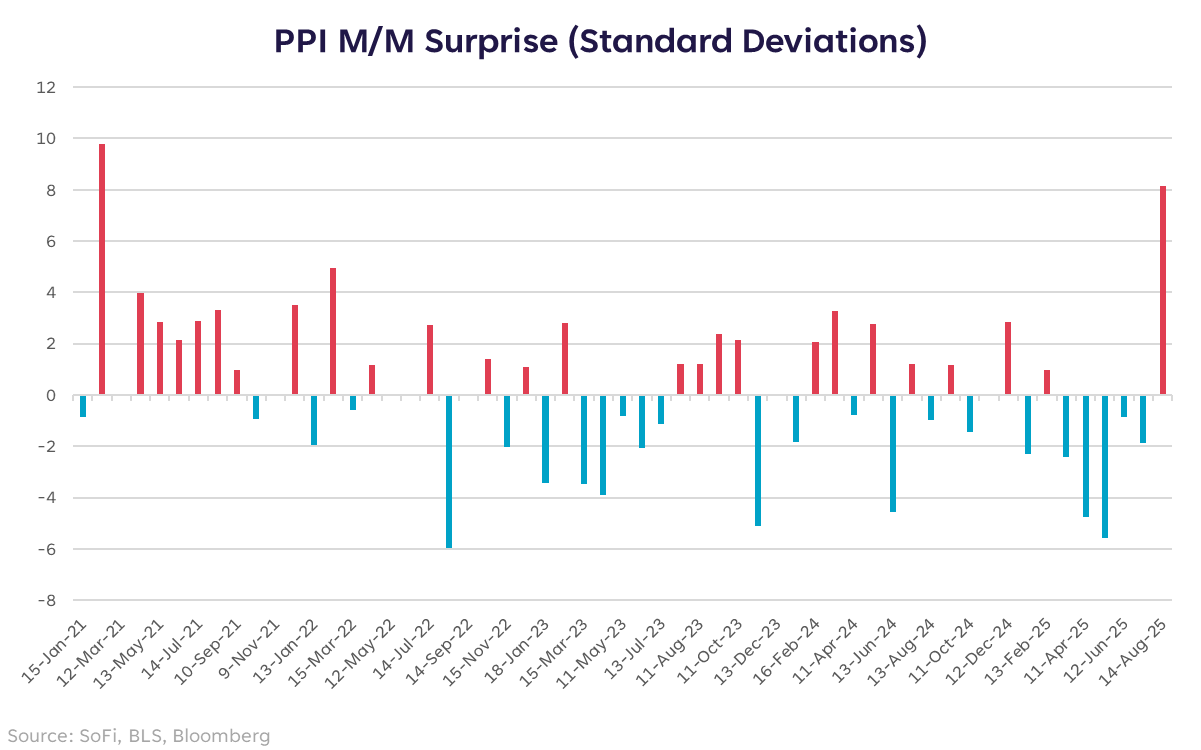

Let’s begin this week’s data dump with the biggest macro surprise of the week.

Yes, we are talking about the PPI, which rattled the markets with a scorching hot print.

In fact, the M/M suprise was an 8-standard deviation surprise, the largest one since the January 2021 PPI was released.

The headline PPI came in at 0.9% MoM v/s Exp. 0.2% and the PPI Core came in at 0.9% MoM v/s Exp. 0.2%.

We have seen that the PPI Final Demand (Services) has been volatile and is directly correlated to the equity market returns.

Thus, with the equity market touching ATHs, the Portfolio Management services came in significantly higher, which was the largest contribution to the higher PPI.

The silver lining is that this is not a part of the PCE and thus, PCE would be tolerable enough for a 25 bps rate cut in September.

Higher services PPI also proves our long-standing point that tariffs are inflationary, and firms will eventually pass on prices to protect margins.

Thus, undoubtedly higher prices (CPI) are inevitable in the coming months.

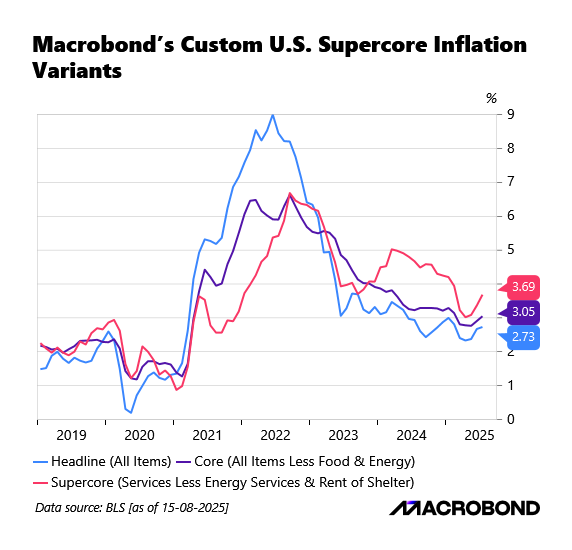

Some market participants cheered the CPI data as it came in line with expectations.

Notably, the headline CPI came in at 0.2% MoM v/s Exp. 0.2% while the Core CPI came in at 0.3% MoM v/s Exp. 0.3%.

However, as usual, the devil lies in the details.

The Core Inflation and the Supercore (Services Ex-Shelter) are once again in an uptrend, demonstrating that the inflation has bottomed out.

Digging in deeper, the Supercore CPI saw a broad base increase across all the components, led by Medical Care and Transportation Services.

Undoubtedly, the core/supercore is turning out to be sticky and with upcoming price increases due to tariffs, the uptrend is here to stay.

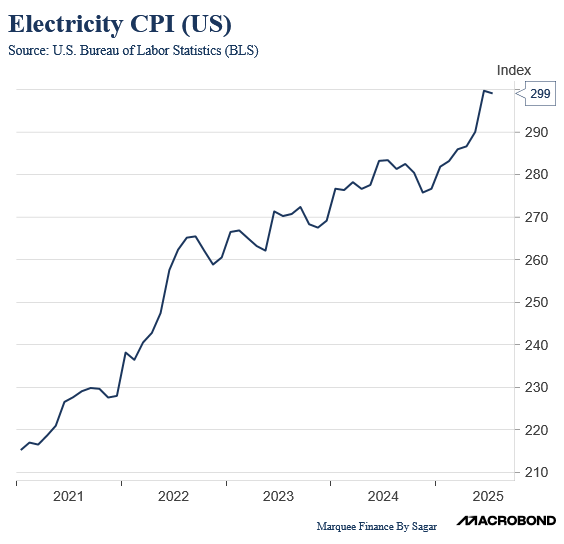

Furthermore, the data centre demand explosion for electricity is now leading to significantly higher electricity CPI, which can further stoke inflationary pressures for low-income households.

If you closely look at the above chart, since the beginning of this year, the index has been up nearly 8-9%.

As a result, we expect the headline CPI to move higher to…