The Nightmare!

For market participants, including the Fed and numerous investors & traders who analyse macro data and position accordingly, a nightmarish scenario is unfolding.

With signs all over that the US Government shutdown will be prolonged, there is a high probability that no macro data will be released this month.

As a result, the Fed will announce the policy decisions without any macro data to analyse, complicating the decision and subsequent market reaction.

Furthermore, with millions of federal workers furloughed, chaos would ensue if the shutdown persists for more than a fortnight.

We are closely monitoring the situation and will discuss the impact of the shutdown on cross-asset moves.

Our consistent performance continues, as the PF has touched all-time highs with a YTD return of 22.32%, outperforming the benchmark by more than 130 bps.

Furthermore, since inception (1st January 2023), we have never had a drawdown of more than 400 bps despite market turmoil during the period.

In fact, the benchmark had a massive drawdown of up to 900 bps on various occasions.

US/Equities/Bonds/Gold/Silver/Copper/Oil/Dollar!

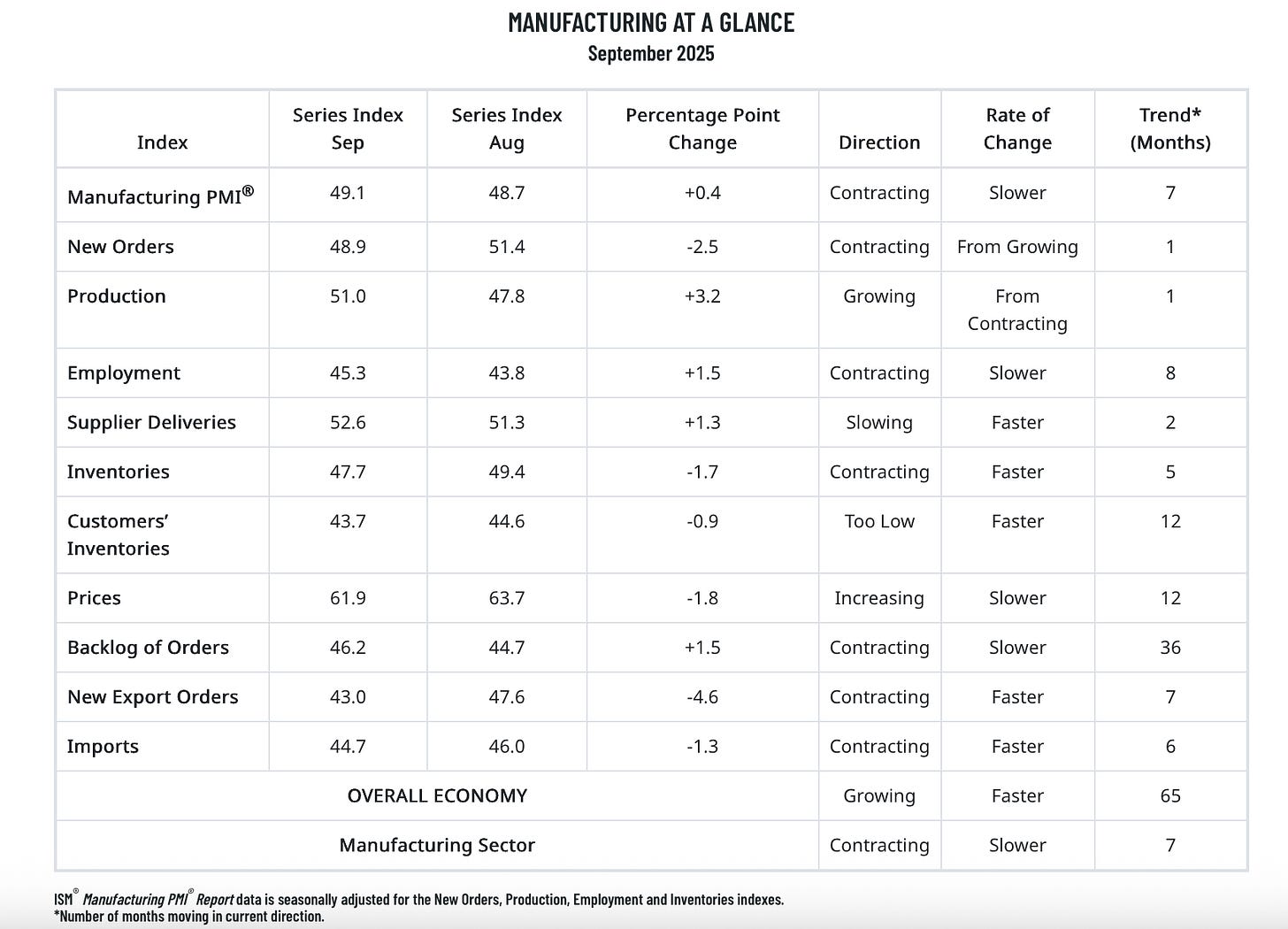

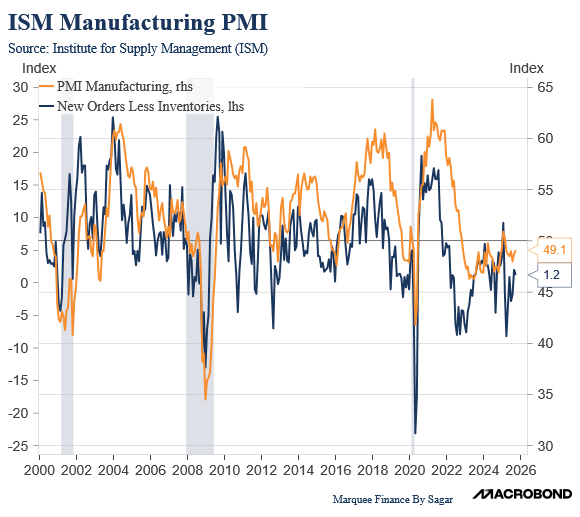

Our favourite indicator to gauge cyclical activity has been the ISM Manufacturing Index, despite market participants raising concerns about the false recession signal it portrayed in 2022.

Note that, as we wrote last week, the AI Capex has been the pivot which has kept the manufacturing activity buoyant.

Although ISM Manufacturing PMI is below 50 (indicating contraction), it saw an improvement MoM, led by a rise in production and supplier deliveries.

Furthermore, New Orders Less Inventories rose once again, indicating that the ISM Manufacturing is expected to rise in the coming months (might even go to expansionary territory > 50).

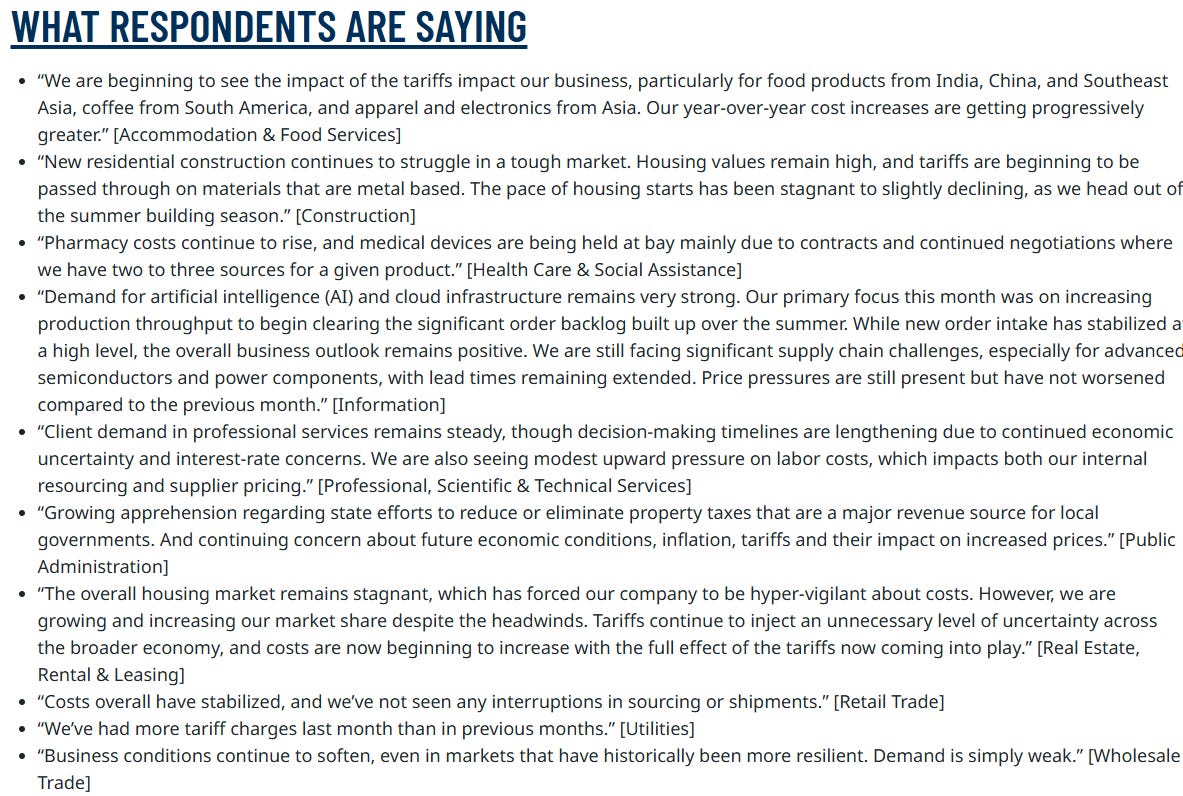

ISM Services just came in at 50, indicating that the services activity is on the verge of contracting.

The comments in the survey were shocking, as most of the sectors (e.g., AI) are having a tough time.

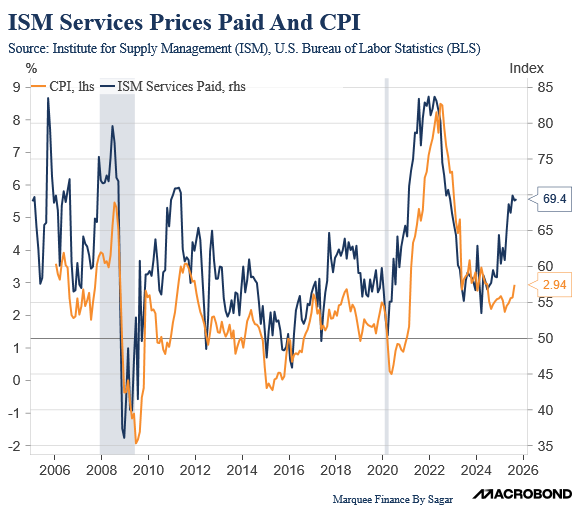

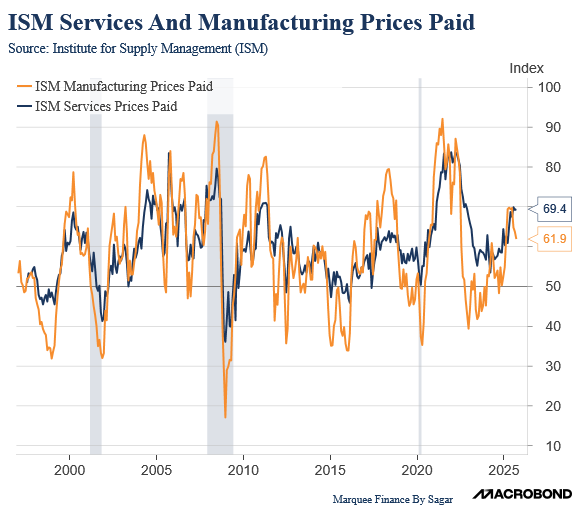

While growth is slowing down, there is no downturn in prices paid, as pricing pressures remain intense.

We have been sharing the chart for the last two months, and if history is to be believed, inflation will witness a spike soon (the extent and duration are unconfirmed).

On the contrary, there has been some softening in the ISM Manufacturing Prices Paid.

Note that both of them have a tight correlation, and we expect the Services prices paid to also cool off eventually (most probably by Q1).

Now, let us analyse the most crucial piece of the puzzle!