The "Pivot" Party!

“Here was a general expectation that rate cuts will be a topic of conversation going forward”- Jerome Powell, 13th December 2023.

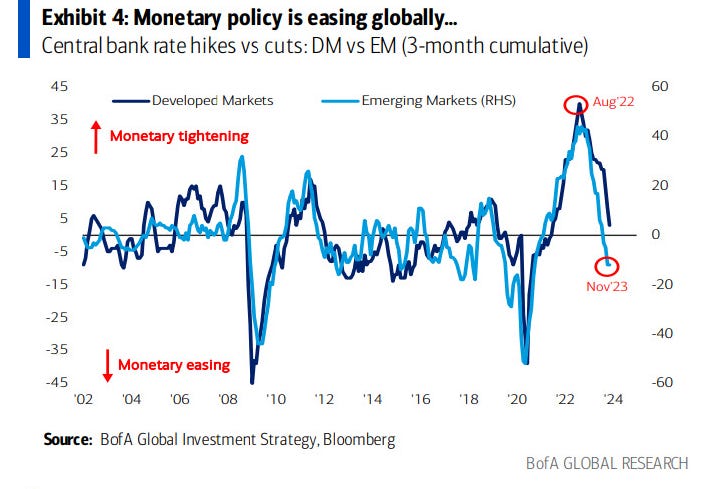

The Central Banks, ex-the contrarian Central Bank (BoJ), all over the world have “terminated” their tight monetary policy and are now at a historic inflection point.

As per BofA, the current rate cuts cycle / monetary easing is led by the EM Central Banks as EMs were well insulated from the inflationary shock that the developed world suffered due to its preposterous fiscal and monetary policies post-COVID.

The risk assets (or, in fact, everything ex-oil and dollar) are partying like drunken sailors with unlimited booze (liquidity) sloshing in the global financial system.

In anticipation of a likely “meltup” we timely entered 3 long equity positions (2 EM stocks / ETFs and 1 large cap US Stock) in the last 12-20 days and reduced cash to around 5% from the highs of 13.5%.

In fact, those 3 positions are currently up 3-10% each.

Nonetheless, as we head into 2024, one must be cautious about equity market valuations and connect the dots before going “all in”.

This week was an eventful week where we received the crucial inflation data in the US along with some super important macro releases across Europe, China and Japan.

Furthermore, in a 360-degree U-Turn, the hawkish Fed pivoted and has now transformed into a “dove”.

JayPo issued dovish “statements” that nobody imagined even in their wildest dreams, thus putting fire into the liquidity-led pivot party.

On the contrary, the ECB and BoE played it safe and had a “hawkish” pause, thus roiling the dollar.

Let’s find out what the macro data is telling us, along with what CBs want to communicate to the markets.

USA!

The much anticipated CPI data was released which came broadly in line with the estimates.

The 12-month core inflation rate came in at 4%. Furthermore, due to the lower readings in the last few months, the six-month annualized rate was down to 2.9% in November from 3.2% in October.

As we discussed even last month, a large part of the fall in core inflation is due to the disinflationary trends in goods inflation.

However, there was a slight uptick in the used cars segment as the base effects began to kick in (note that we saw extreme disinflation last year).

Long-time readers will reckon that we guided for a 3-4% headline print by mid-2023 and discussed in detail that the path to 2% inflation (especially Core) will be arduous.

Furthermore, a “consistent” 2% reading will only materialise if there is a significant softening in the labour market (lower nominal wages) or the economy comes to a screeching halt.

This was visible in this week’s CPI data as the Fed’s preferred gauge