The Roller Coaster Ride!

“Credit is the air that financial markets breathe, and when the air is poisoned, there is no place to hide”- Charles R. Morris.

The news flow in the last few days on multiple fronts, including the US-China trade war, shutdown, and subprime auto crisis, has led to extremely volatile cross-asset moves.

We witnessed a significant sell-off in the speculative parts of the market, where notable froth and extreme euphoria were evident.

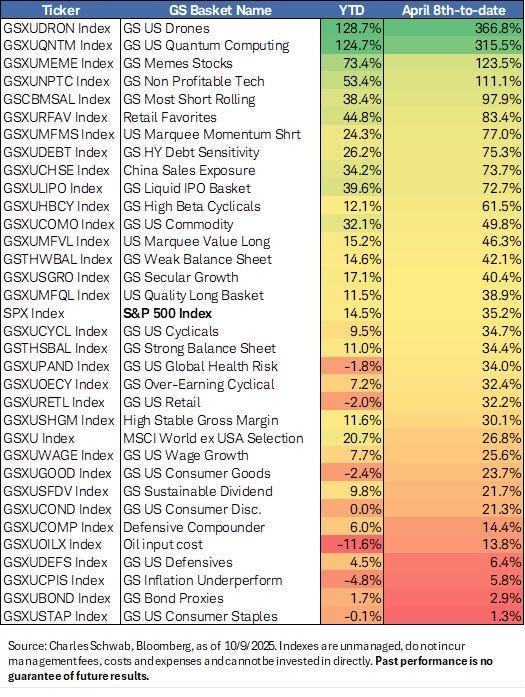

For those who missed it, we are once again sharing the chart (returns as of 9th October 2025).

Thus, we can conclude that beneath the surface, the markets are healing.

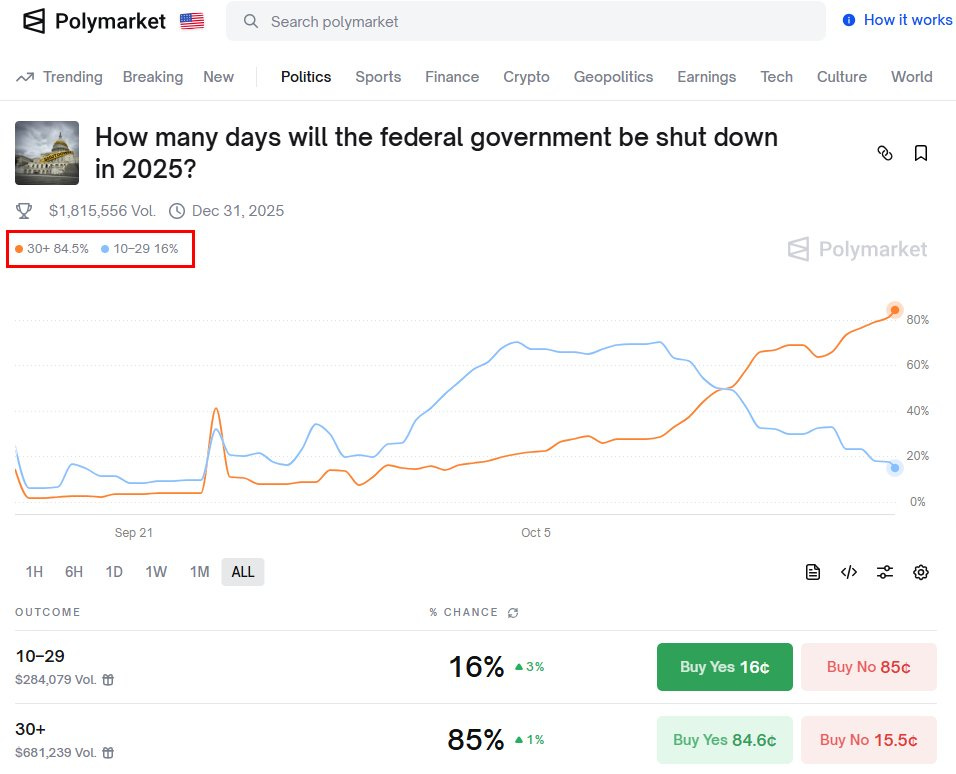

On the other hand, there is a complete stalemate in Washington. As per Polymarket, there is an 85% probability that the Federal Government shutdown is now expected to last more than 30 days.

For macro investors, traders, the Fed and policymakers, it will be catastrophic.

Furthermore, the White House is using this opportunity to permanently layoff tens of thousands of workers which will lead to a rise in unemployment rate and claims data in the coming weeks and months.

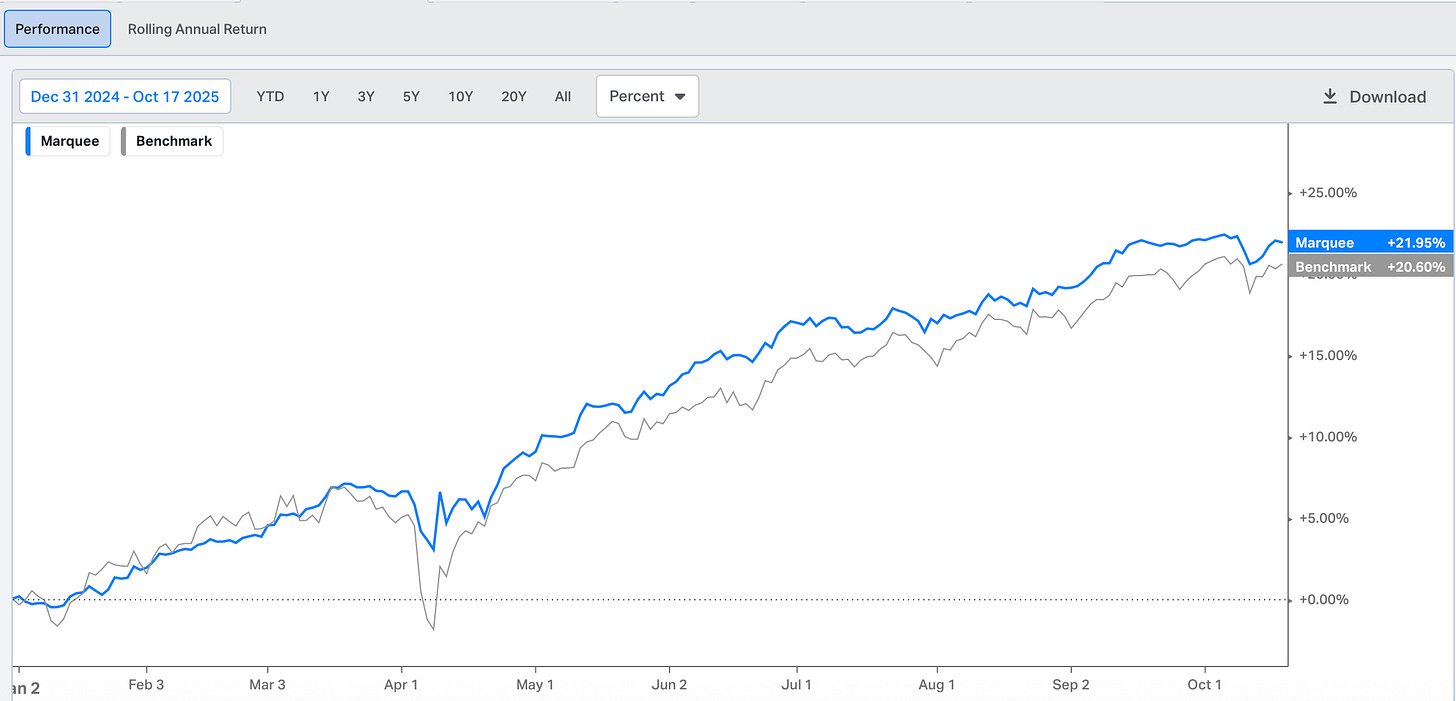

Despite market chaos, we are now just 40 bps from ATHs, and are outperforming the benchmark by more than 130 bps as of yesterday.

US/Equities/Bonds/Gold/Silver/Oil/Dollar!

While corporate earnings from large banks have been a beat, with earnings surprises across the board, credit concerns have resurfaced, particularly in the auto sector’s subprime debt.

Apollo is emerging as the Michael Burry of the current subprime credit crisis.

Apollo shorted First Brands’ debt before its $10B+ collapse.

Now Apollo (along with Sona and Axebrook) is shorting Adler Pelzer, another auto-parts supplier.

The auto sector was the one which emerged unscathed during the GFC; however, due to reckless lending, it’s in the limelight this time.

Nevertheless, we will discuss later why we don’t think we are in a systematic credit crisis “YET”.

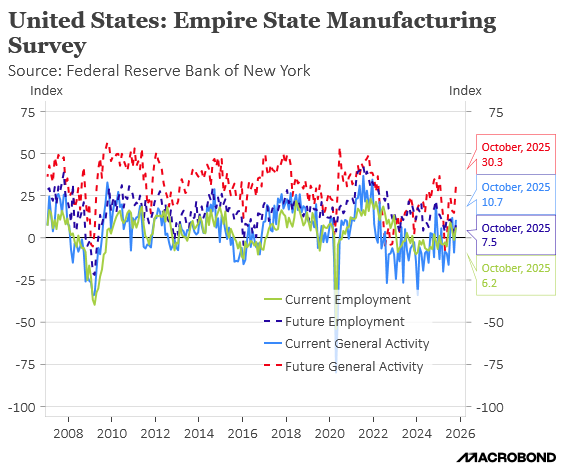

In the absence of macro data due to the government shutdown, we analyse soft data released this week.

The Empire State Manufacturing Survey's future activity jumped to one of its highest levels this year, indicating that manufacturers are optimistic about the future.

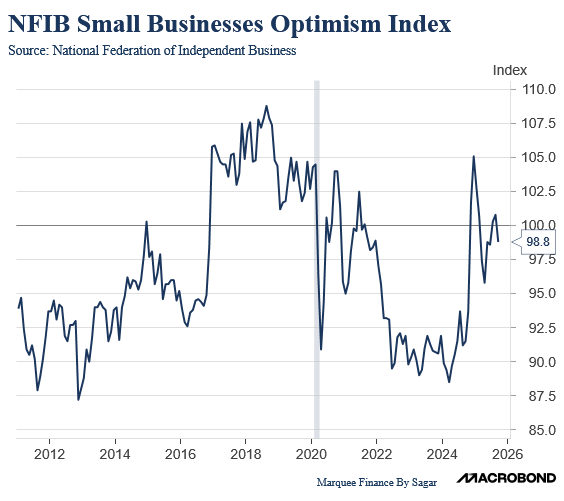

We also got the NFIB Small Business Survey.

Note that the Survey leans Republican, and therefore, we get positive readings during a Republican President and vice versa.

The headline index fell to 98.8, down from the previous month's reading of over 100.

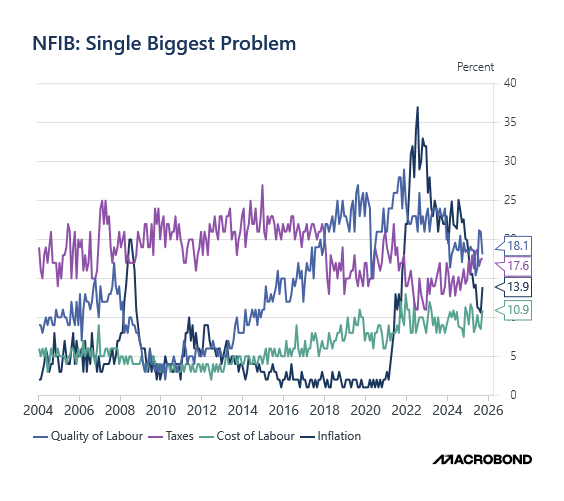

Interestingly, one of the significant data points in the survey is the Single Biggest Problem.

A detailed analysis divulges that inflation & cost of labour (the single biggest problem) have once again begun rising (the stagflation risk).

Taxes due to tariff impact also remain elevated.

Let’s move to the “only” labour market data that we could derive this week (from NFIB):