Uncertainty, Uncertainty And Uncertainty!

“Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation.

It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy.”- Jerome Powell.

Since we began this newsletter three years ago, this is the first time we have had such an elaborate opening statement by Jerome Powell (FOMC).

We believe it was a balanced statement demonstrating that the Fed is not politically biased. Furthermore, the above statement caught our eye as we were the first to point it out in our Global Outlook in December.

The cross-asset movement this year will solely depend on the policy decisions made by the Trump administration. We further wrote last month that the administration is targeting long-term gains, but the process involves short-term pain, which may even entail a recession.

Nonetheless, according to various estimates (GS to BBG), the recession probability is still pretty low, at about 20-25%.

On the other hand, if you think only the Fed is talking about uncertainty, then you missed Ueda’s (BOJ Governor) comments this week:

“Overseas uncertainty has heightened sharply lately, while there are other factors that could become clearer down the road. It’s hard to quantify the risk. But we could take into account some elements (of the impact of US tariffs) in our April quarterly report.”

Not only the BOJ but also the BOE flagged the “uncertainty” surrounding the global economy.

“Since the MPC’s previous meeting, global trade policy uncertainty has intensified, and the United States has made a range of tariff announcements, to which some governments have responded. Other geopolitical uncertainties have also increased, and indicators of financial market volatility have risen globally.”

Thus, it’s a no-brainer that the Global Economic Policy Uncertainty Index has climbed to its second-highest levels.

With this backdrop, let’s dig deeper into the macro universe and comprehend the cross-asset moves.

US/ Bonds/ Gold/FX!

“While these individual forecasts are always subject to uncertainty, as I noted, uncertainty today is unusually elevated. And, of course, these projections are not a Committee plan or a decision.”- Jerome Powell.

The most significant takeaway from the FOMC was the “elevated uncertainty” that JayPo mentioned numerous times during the presser and in his statement.

Notably, policy flip-flops, especially trade policy, are creating a challenging environment for the Fed as it becomes cumbersome to project GDP growth, inflation, and unemployment.

Nonetheless, the statement mentioned:

“In our SEP, FOMC participants wrote down their individual assessments of an appropriate path for the federal funds rate, based on what each participant judges to be the most likely scenario going forward—an admittedly challenging exercise at this time, in light of considerable uncertainty.”

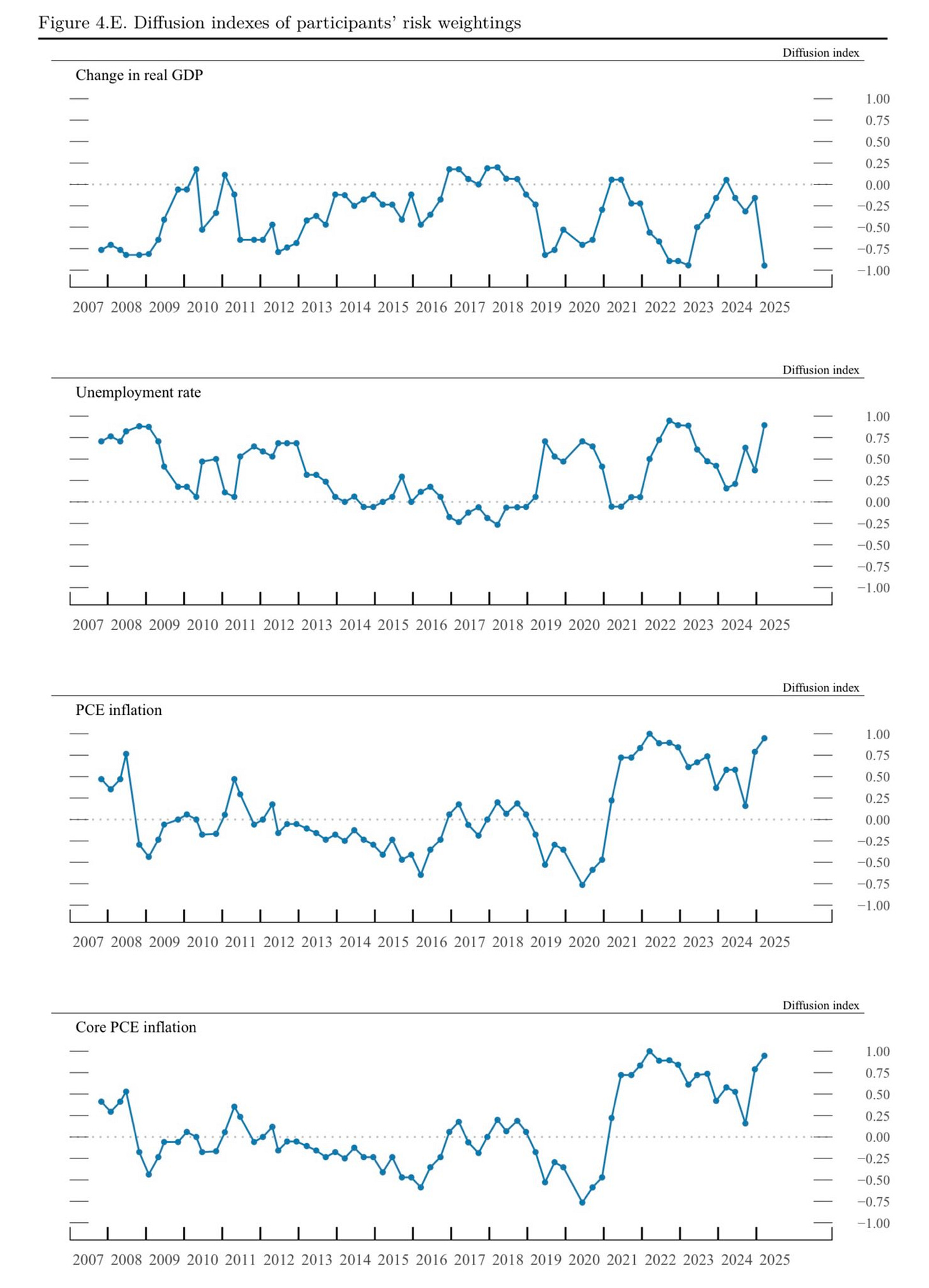

With this backdrop, the dot plots in the SEP indicated only one macro outcome: “Stagflation.”

The second biggest takeaway was the tapering of the Quantitative Tightening (QT), which we mentioned in the Global Outlook and predicted would be done sometime in H1 (end Q1/Q2); and here we are.

After a record balance sheet decline of $2 trillion in the last two years (the largest drawdown ever in percentage terms), the Fed reduced the monthly cap on Treasury redemptions from $25 billion to $5 billion. Note that JayPo also mentioned that he has seen some signs of increased tightness in money markets.

Let us move to the two most significant dynamics of the macro world to comprehend the direction of the US economy: