As we end 2024, we are glad to present our year-end review. Thanks to our timely bets on the bond markets, FX markets and Thematic Investing equities, we generated significant alpha this year (420 bps).

The average performance of macro HF up to 30 November was 8.88% (we were at 9%+); thus, we slightly outperformed the global macro HFs.

Furthermore, though we had limited US exposure due to valuation concerns, our bets on Japan, Europe, and China helped us deliver superior equity performance.

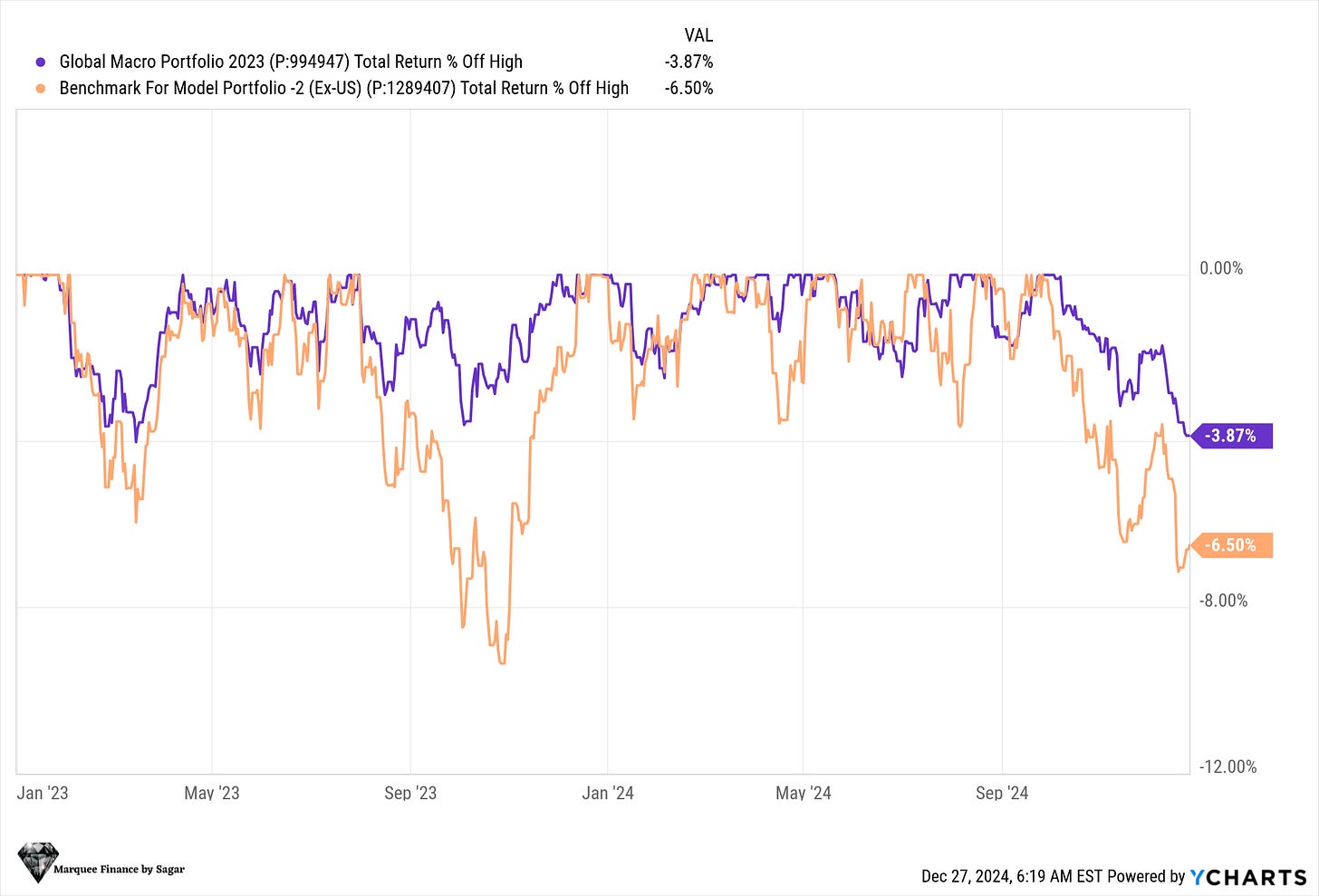

When we look at our performance since inception, we have had 16%+ overall returns with minimal drawdowns (a lot better than the benchmark, with the maximum drawdown being the current 3.9%).

As always, there were hits and misses. Today, we will reflect on what went wrong and how we could perform better in 2025, fine-tuning our macro framework further.

Winners!

Let us go through all our winners first:

Total Profitable Exits/Trades/Partial Exits across Equities :

BWXT (Thematic Investing): Profit of 80% (holding period 1 year)

GDX (Gold Miners): Profit of 28% (holding period 3 months)

XLU (Utilities): Profit of 28% (holding period 14 months)

DBEU (European Hedged Equities): Profit of 25% (holding period 16 months)

SIL (Silver Miners): Profit of 22% ( holding period 2 months)

EWJ (Unhedged Japan): Profit of 15% (holding period 10 months)

TSLZ (Short TSLA): Profit of 15% (holding period few weeks in August)

NVDD (Short NVDA): Profit of 14% (holding period 1 month)

BRK.B: Profit of 14% (holding period 7 months)

XOM: Profit of 13% (holding period more than 15 months)

Long MSFT/Short NVDA: Profit of 9% (around 2 months).

EWY (Unhedged South Korea): Profit of 8% (holding period 5 months)

DXJ (Hedged Japan): Profit of 7% (holding period 3 months)

AMZN: Profit of 5% (holding period few days)

CXSE/CQQQ (Chinese ETFs): Profit of 4-8% (holding period 12 months)

Total Profitable Exits/Trades/Partial Exits across Bonds:

TLT: Total gain of 10% (2-3 months)

IEF: Total gain of 10% (3-4 months)

TMF: Total gain of 7% twice

Total Profitable Exits/Trades/Partial Exits across Commodities/PMs/FX :

Gold (GLD): Profit of 45% (holding period 20 months)

UCO (Long Oil): Total Gain of 19% in 2 trades in Jan/Feb

UCO (Long Oil): Total Gain of 11% in 1st week of October

URA (Uranium): Profit of 6.5% (holding period 15 days in August)

SLV: Profit of 5% (less than a week in August)

FXY: Short USDJPY (July): Profit of 4% (holding period 15 days)

Some of our best calls this year have been:

We had enormous gains via Gold and Gold Miners (GDX). We captured the rally from $1800 to $2700, generating a tremendous return of more than 45% on GLD and 28% on GDX. The biggest takeaway was that we exited timely and rightly predicted the top in Gold.

BWXT, our top Thematic Investing bet, almost became a multi-bagger. However, we sold it at $121 due to valuation concerns and the hype that was generated after the big tech companies became bullish on nuclear.

Entering the Silver Miners (SIL) just when Silver was ready to take off, we could have played via SLV, but since miners were undervalued, we decided to jump in early April. Booked gains when Silver touched $31 in H1.

We bought utilities (XLU) when it was the most hated, as bond yields reached 5% last year. The top defensive bet got us 28% returns, and we sold at the peak euphoria (when utilities were pumped using AI).

The long oil trade worked wonders in January/February, as we captured the upmove nicely despite Qatar's fake news.

We had been bullish on Japanese equities since the inception of our Model PF, and we rode the whole move higher in DXJ from $64 to $88, again entering at $101 and exiting at $109. Along with EWJ in between, we garnered a sizeable return via Japanese equities (around 50%+).

Europe via hedged ETF (DBEU) has been a stark outperformer, and we had our European exposure via DBEU to avoid currency risks. We logged significant gains before we decided to sell it off.

We gradually entered long-duration bonds in April and May when the yields were above 4.5-4.6% and booked all the profits when the yields moved down to 3.6-3.7% in August/September.

Equities!

We have beat our benchmark by 140 bps in our equity portfolio with minimal drawdowns.

Let us look at our open positions: