The "Macro Mess"™!

Last Saturday, we wrote Explosive Setup Part 3.0 and predicted the following:

S&P500 will fall to 6520 this week, and other global markets will fall in tandem, especially those “overheated”.

Bitcoin will reach $86-87k amid a broad crypto sell-off.

The bond market will rally, especially post the release of NFP on Thursday.

Gold will fall as debasement trade goes out for a toss.

Out of the four, we got three right despite a massive gap open in equity markets post the NVDA results, which were “supposedly” an enormous beat amid an optimistic outlook.

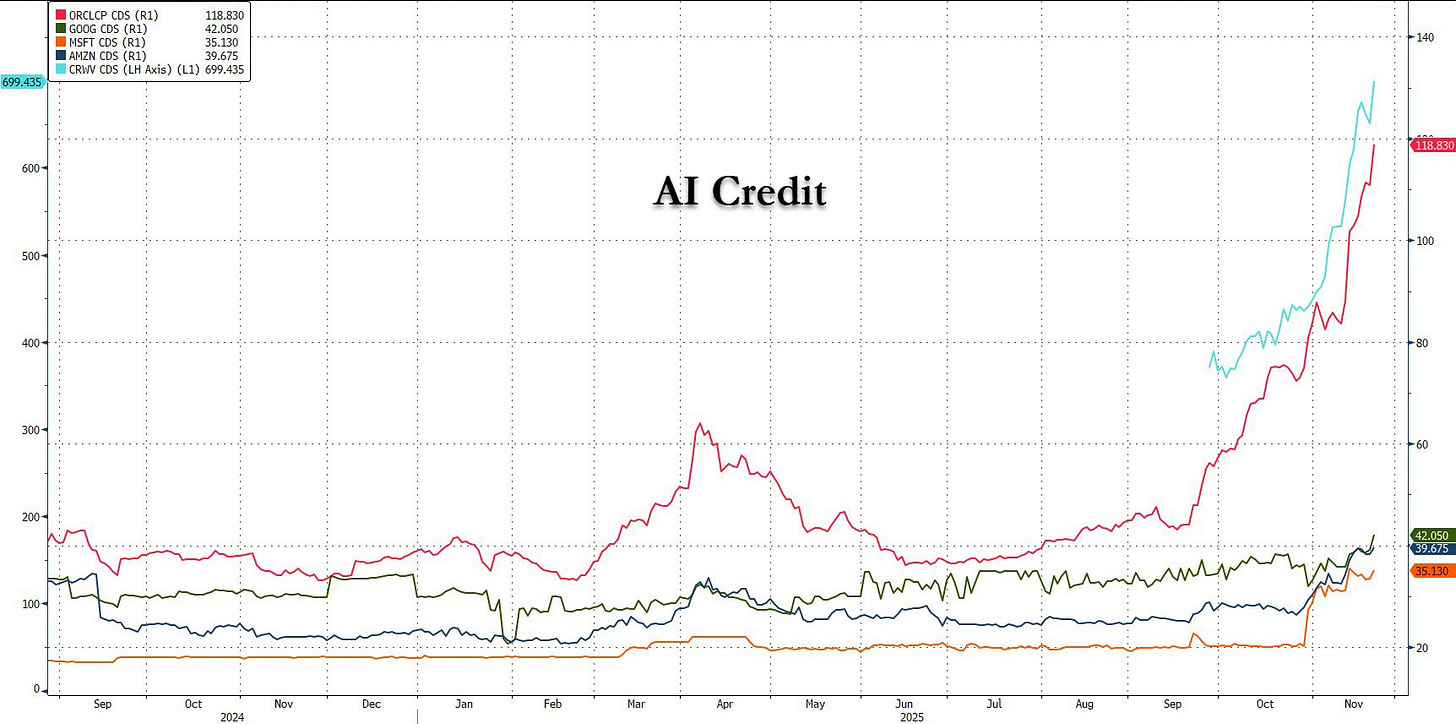

Nonetheless, credit markets continue to signal the demise of the AI trade, with CDS prices going parabolic, especially for the weaker names (CRWV, ORCL) in the circular AI ecosystem.

The last month's AI rally was global, and thus we are witnessing cracks developing in the East as the markets punish Golden Boy Masa, who sold all his NVDA stake to honour his more than $20 billion investment in OpenAI.

Softbank Group stock, which rose 45% last month, is now down 38% from its highs and has given up all its gains since mid-September.

As the levered AI trade unwinds globally, the macro outlook is worsening for the West and in the East, preposterous policies are unveiled in Japan.

Despite elevated volatility and market turmoil, we are hovering around the 20% mark for our YTD performance as we raised cash on time.

Let us dig deeper into the macro universe and analyse the cross-asset moves.

US/Equities/Bonds/BTC/Gold/Silver/Oil/ Dollar!

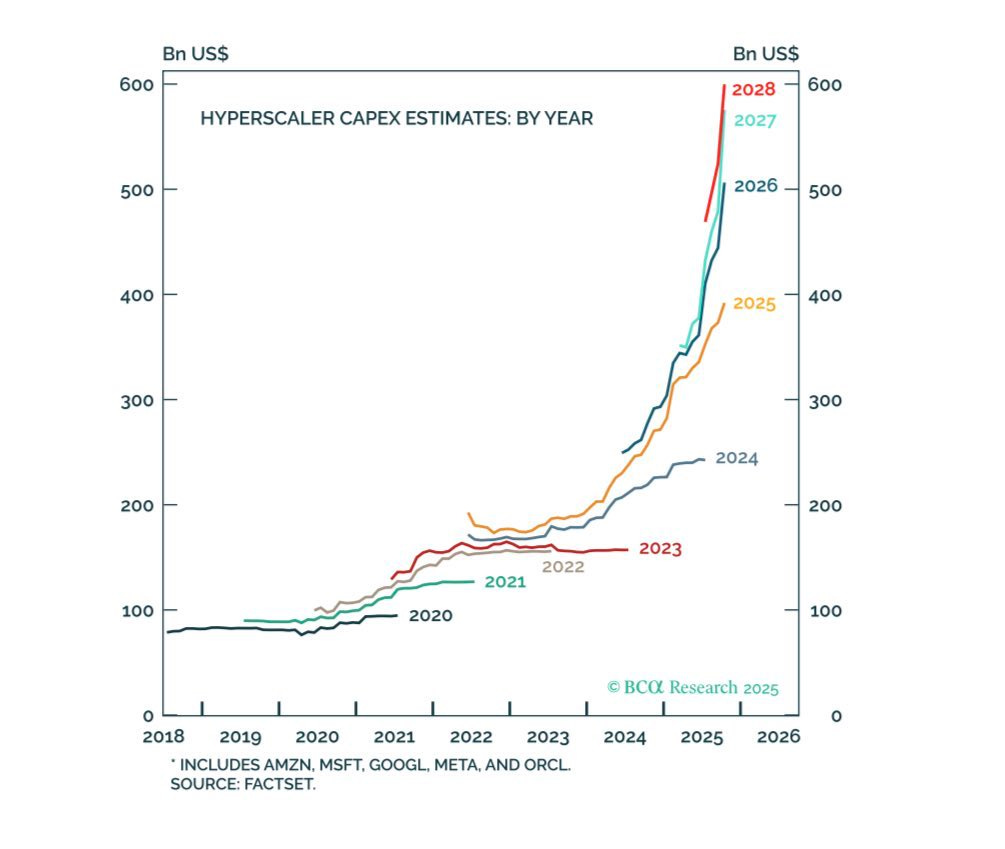

Before we discuss the macro data, we want to highlight intriguing charts from BCA Research on the AI rollout and capital expenditure (CAPEX).

The first chart shows US Investment in Information Processing Equipment and Software as a % of GDP, or, in other words, it measures the burgeoning capex by tech firms over the years relative to GDP.

Interestingly, we are now nearly at dot-com levels, so the street’s concerns seem legitimate.

We believe that hyperscalers should focus on optimisation rather than aggressive spending, especially in data centres, given an acute electricity shortage as data centres sit idle waiting for power.

The second chart exhibits the total AI assets the hyperscalers will hold if they continue spending at the current pace, based on market estimates.

Assuming a 20% depreciation rate on $2.5 trillion AI assets (by 2030), the depreciation expense would total $500 billion per year.

Notably, this is more than their combined 2025 profits.

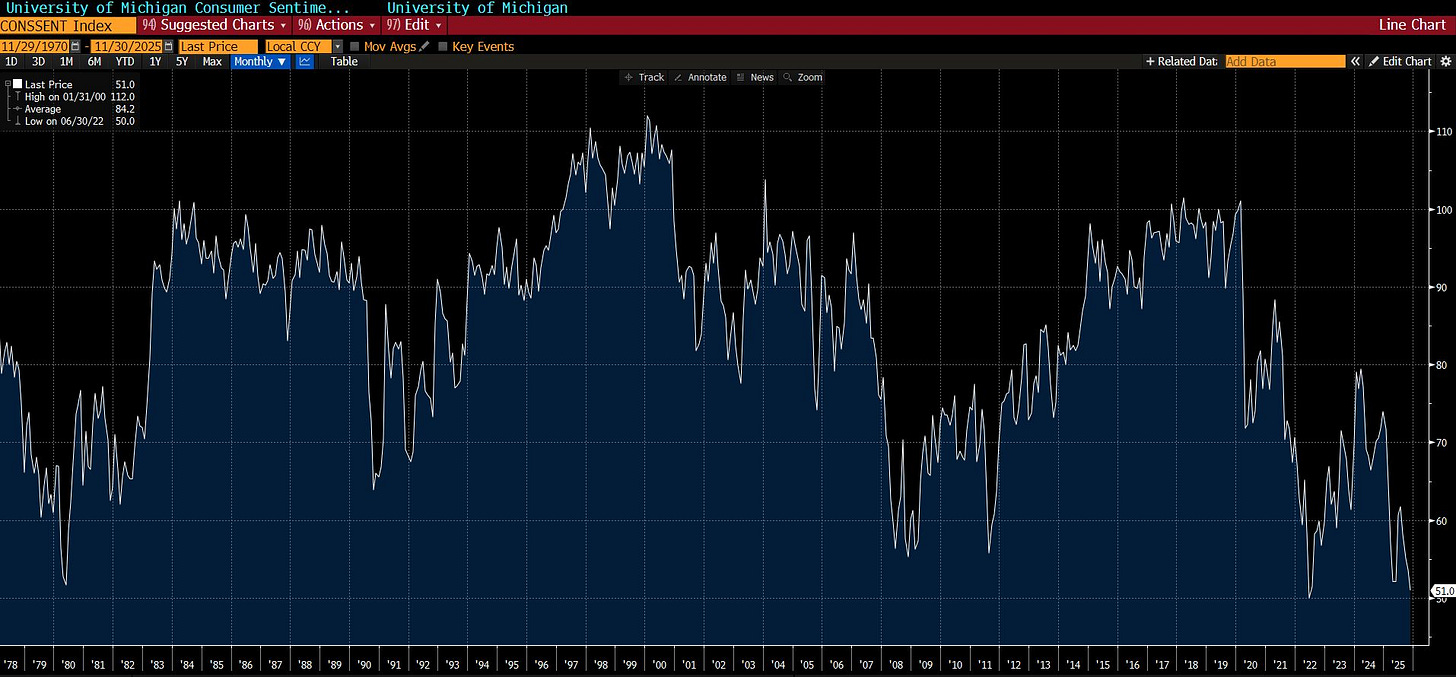

Moving on to macro, since the last two weeks, we have been highlighting the plunging consumer sentiment in the US as measured by the UMich Consumer Sentiment Index.

We are now at levels last seen in the 80s, when the great inflation shock of the 70s (oil was up 10X) led to a significant deterioration in the quality of living.

One measure of consumer health is the Misery Index, which combines inflation and the unemployment rate (UR) to gauge the economic distress consumers experience.

As we can observe, during the 70s era of stagflation, the high UR and inflation pushed the Misery Index to 20+.

Although the Misery Index is relatively low today, the U6 unemployment rate is 8% and the true inflation rate is significantly higher than reported.

Furthermore, as we have been demonstrating over the last few months, the K-shaped economy means that a considerable portion of the population is under severe stress.

Let’s now analyse the labour market where the trouble is brewing: